Over the past 23 years, with the support of our customers, we have been able to invest and grow our presence in the UK.

We wanted to share a snapshot of our economic impact in the UK during 2021, including our tax contributions – which total more than £2.77 billion - to provide a better understanding of our UK business and how we support the communities where we operate.

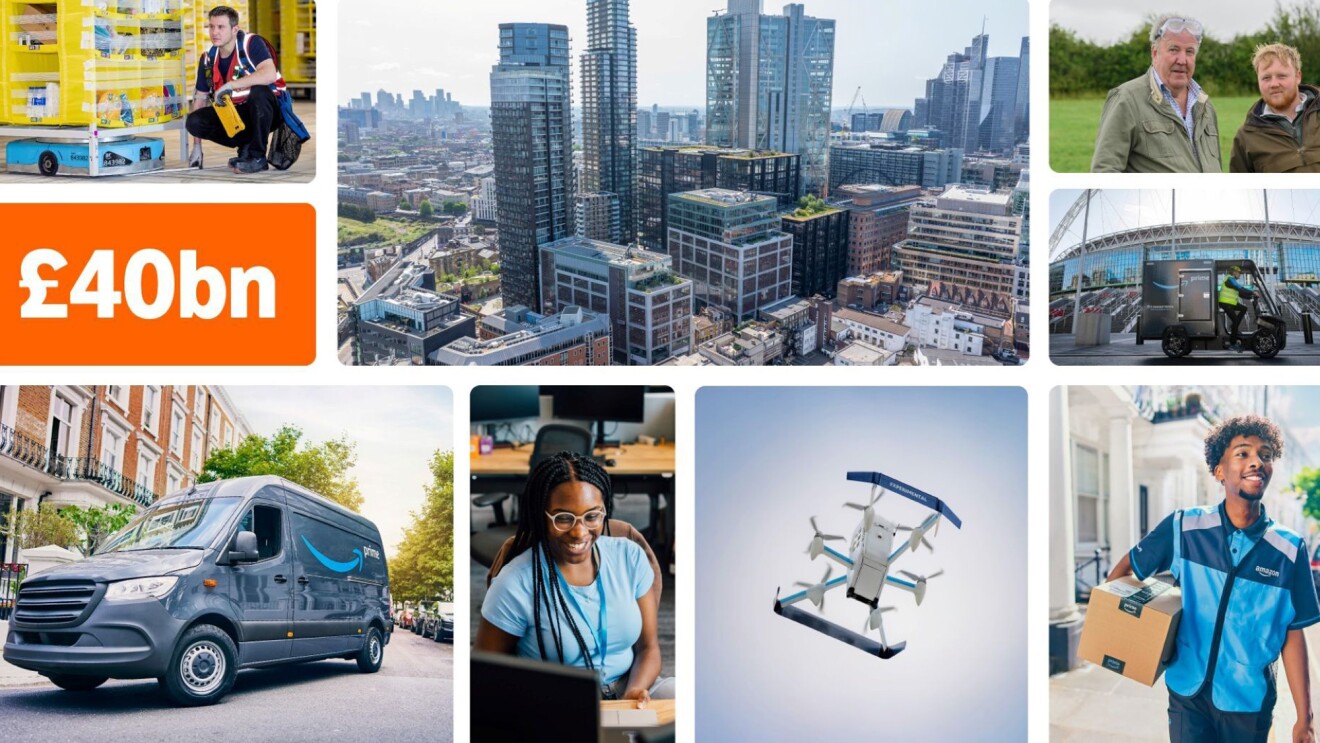

Our investment in the UK

Since 2010, we’ve made direct investments in our UK operations of more than £43 billion. This includes both capital expenditure (such as the infrastructure we build, including our fulfilment centres, corporate offices and data centres), and operating expenditures (such as the jobs we create in the UK). These direct investments raise the economic activity in a given region. This investment also creates a ripple effect through the economy as the firms that supply goods and services to Amazon expand and associated household spending increases.

Last week, we announced that we are creating a further 4,000 permanent roles across the UK in 2022, taking our total permanent workforce to more than 75,000. These new hires are spread across the UK, with the top three regions of growth being Yorkshire and Humber, the North East, and the South East, as well as a significant expansion at our UK HQ in London. This comes after we announced, earlier this year, that we created more than 25,000 permanent roles across the UK in 2021. The new roles are across a variety of corporate and R&D functions in Amazon and Amazon Web Services (AWS), including software development, product management, and engineering, as well as the operations teams in our fulfilment centres, sort centres and delivery stations across the UK.

Many of these jobs are filled by people starting their career or returning to employment. According to new hires in Amazon fulfilment centres surveyed in 2021, more than half were previously out of work or joined directly from education. Pay for Operations roles starts at a minimum of £11.10 p/h in the London area and £10.00 p/h in other parts of the UK, more than the UK’s National Living Wage. We also continue to invest in training and skills programmes for our employees – in 2021, we created more than 1,000 apprenticeships, and we now have more than 4,000 Amazon employees enrolled on Amazon’s Career Choice training programme.

In addition to our direct job creation, our investment indirectly supports a large number of jobs in our UK supply chain and across the network of over 85,000 UK-based small and medium-sized enterprises (SMEs) sellers who sell their products in Amazon’s stores across the world and use the tools and services we build to help them grow. To date, UK SMEs selling on Amazon have supported over 250,000 jobs in the UK to help build their business online. This is an addition to the more than 160,000 additional jobs supported through Amazon’s supply chain, according to independent economic consultancy, Keystone. If you combine our direct employment with these indirect employment effects, Amazon enables employment for more than 410,000 people across the UK.

We also continue to invest heavily in renewable energy and sustainability initiatives. We have 18 on-site solar projects powering our facilities across the UK, and plans to more than double the number of projects by 2024. Amazon is the largest corporate buyer of renewable energy in the UK and worldwide, and we continue to invest in new wind farm projects, including the Moray West Wind Farm located off the coast of Scotland. All of these projects are part of Amazon’s ambition to power 100% of company activities with renewable energy by 2025, which is five years ahead of the original target of 2030. Investing in renewable energy is one of the many actions Amazon is taking as part of The Climate Pledge, a commitment to be net-zero carbon by 2040, 10 years ahead of the Paris Agreement.

Our tax contributions in the UK

As we continue to make investments in our UK operations and our growing workforce, we help fund public services and infrastructure throughout the country. We do this through the taxes that are collected by the Exchequer as a consequence of our activities in the UK. Those taxes fall into two categories:

- Directly incurred taxes: the taxes that are directly incurred and payable by Amazon, including Employer National Insurance, Business Rates, Corporation Tax, Import Duties, Stamp Duty Land Tax and Digital Services Tax; and

- Indirect taxes collected: the taxes we collect and remit from our customers, employees, and other third parties because of our business activities in the UK. These include VAT and the taxes paid by our employees through PAYE.

These different categories of tax are important, because indirect contributions to Government revenue would not be collected (or generated to the same extent) if we did not offer services or products to our customers who are responsible for paying the tax in question, or if we did not procure goods and services from our suppliers on which such taxes are due. This trend is particularly relevant for growing businesses such as Amazon which continues to invest in its UK workforce and infrastructure. Amazon also has a high volume of sales, but operating profits remain relatively low due to price pressure in competitive markets and intense capital investment programmes.

This means that focusing on one aspect of taxation, such as Corporation Tax, doesn’t tell the whole story. This is one of the reasons why PwC produces a total tax contribution study for The 100 Group (an organisation which represents the Finance Directors of the UK’s largest companies, including many FTSE 100 firms). During 2020 we made a total tax contribution of £1.55 billion – £492 million in taxes borne and £1.06 billion in taxes collected. Based on analysis from PwC, when compared to the most recent PwC Total Tax Contribution survey of the 100 Group, Amazon ranks in the top 15 largest UK taxpayers for taxes borne and collected, as well as for the overall total tax contribution. Amazon would also rank third in terms of total capital investment in 2020. The 100 Group represents members of the FTSE 100 along with several large UK private companies, and the survey ranks companies in terms of their contribution to the UK government’s tax receipts.

Most governments — including the UK Government— use the taxation system to actively encourage companies to make investments in infrastructure and job creation. The super-deduction – an enhanced capital allowance of up to 130% on new qualifying plant or machinery expenditure – is one such example. The stated purpose of this capital allowance was to encourage businesses to make productivity enhancing investments and promote economic growth. Any tax reduction as a result of these capital allowances is more than made up for by the thousands of additional jobs created and the economic growth which has been stimulated by these investments.

Over the past two years, we have seen increases in our operating costs as we doubled the size of our global fulfilment network which we had built over Amazon’s first 25 years. In the UK, this meant we invested more than £2.3 billion in infrastructure last year (during 2021) as we opened four new fulfilment centres in Swindon, Dartford, Gateshead and Hinckley, as well as a new receive centre in Doncaster, with three of these fulfilment centres fitted out with our latest robotics technology. We also continued to invest in building and operating data centres in the UK in order to meet the growing needs of our customers and to help strengthen the UK’s digital infrastructure. Many of these sites are in parts of the UK with a history of higher unemployment and lower investment, which is just one of the ways Amazon is contributing to the UK’s levelling up agenda.

For the past three years, we have published our UK investments, directly incurred tax charge and indirect taxes collected. Below we have outlined our contribution for the full year to 31 December 2021:

- In 2021, the total revenues of Amazon’s activities in the UK were £23.19 billion (2020: £20.63 billion)

- We also invested £11.4 billion in the UK last year. This includes more than £2.3 billion in our infrastructure, as we continued to expand our fulfilment centre portfolio and create new jobs. This is an increase on our infrastructure investments in 2020 (more than £1.6 billion) and is comparable to our combined spend for the two prior years.

- Our total tax contribution (combining directly incurred and indirect taxes) was £2.77 billion (2020: £1.55 billion).

- Our total directly incurred taxes were £648 million (2020: £492 million). Increases in 2021 were largely driven by headcount growth and the expansion of our real estate footprint.

- The indirect taxes we collected were an additional £2.13 billion (2020: £1.06 billion) as a result of our business activities in the UK. Increases during 2021 were largely driven by Net VAT. From 1 January 2021, Amazon has been collecting and remitting UK VAT on transactions involving overseas sellers. This VAT is calculated by Amazon and collected from the customer at checkout. Amazon then remits this directly to the UK Tax Authorities.

We believe that corporate tax codes in any country should incentivise investment in the economy and job creation and we support the Organisation for Economic Co-operation and Development and its work with global governments to review the international tax system and secure consensus on the taxation of the digital economy.

We are proud of the significant economic contribution we are making to the UK economy. We know that the UK remains full of opportunity and we continue to be excited by the potential to make investments across the country and have a positive impact in communities.

Read more about Amazon’s work in the communities we operate in.